Buying a Home Treadmill With FSA/HSA Funds

Buying a treadmill with pre-tax dollars sounds appealing — especially if you’re using it for health reasons. But when it comes to Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs), the rules aren’t as straightforward as many retailers make them seem.

The short answer is YES, you can buy a treadmill with FSA or HSA funds — but only in limited, medically necessary situations.

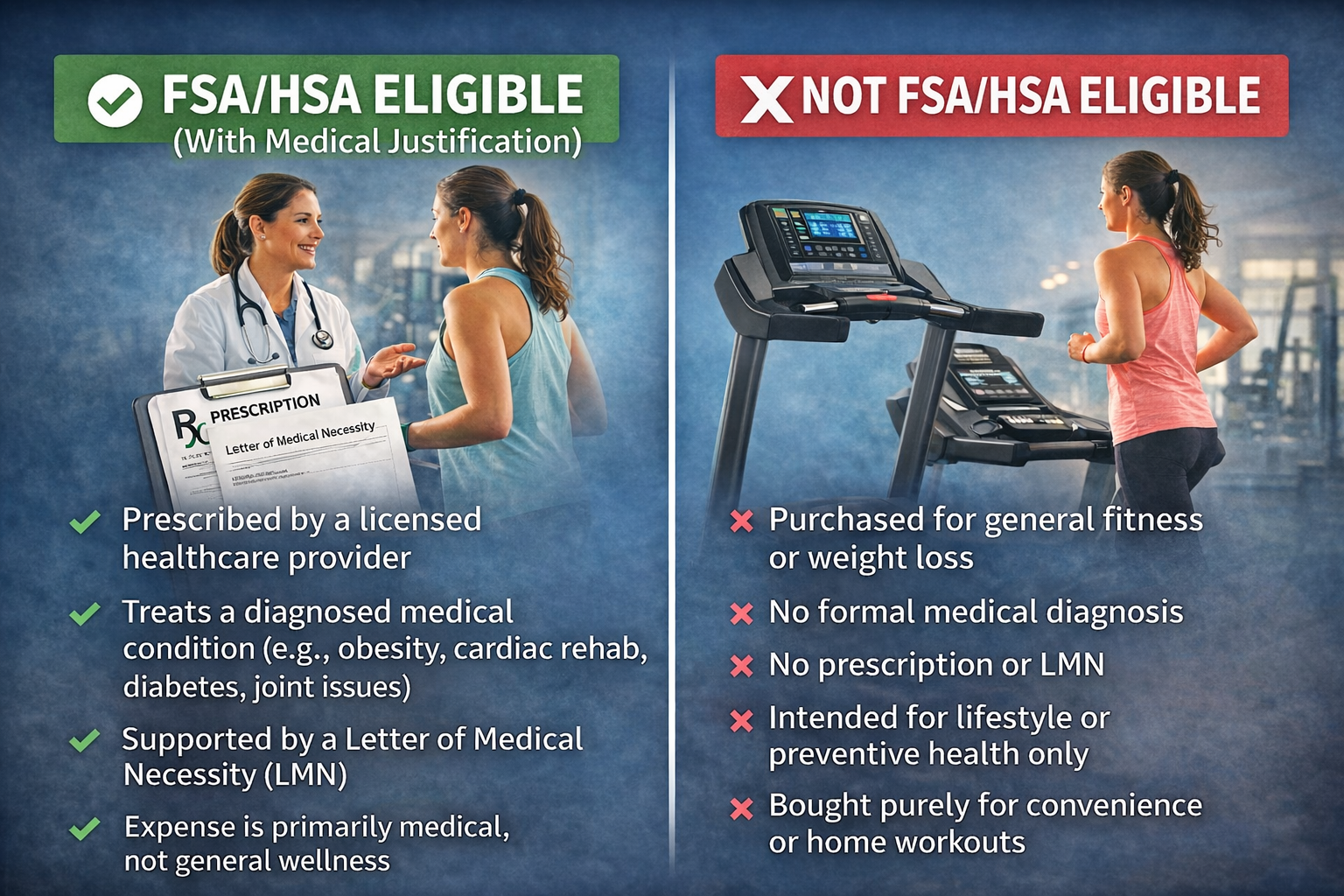

A treadmill is not automatically eligible just because exercise is “good for you.” Under IRS rules, it must be purchased primarily to treat or manage a diagnosed medical condition, not for general fitness or convenience.

So here’s a comprehensive breakdown of when a treadmill can qualify, when it does not, and exactly what documentation you need to avoid reimbursement issues. This should answer any questions you may have.

How the IRS Defines Eligible Medical Expenses

When determining whether something qualifies for FSA or HSA reimbursement, the IRS does not ask whether it’s healthy or beneficial. Instead, it focuses on medical necessity.

Under IRS rules, an eligible medical expense is one that is primarily used to:

- Diagnose a medical condition

- Treat or manage a disease

- Reduce the effects of an illness

- Prevent a diagnosed condition from worsening

This means the expense must be tied to medical care, not general wellness or lifestyle improvement.

A key concept the IRS applies is primary purpose. If an item is mainly used for medical treatment, it may qualify. If it is mainly used for general fitness or personal use, it does not — even if it has health benefits.

Treadmills fall into a gray area because they are commonly used by people without medical conditions. As a result, they are not automatically eligible under FSA or HSA rules.

While exercise can improve health and help prevent future problems, buying equipment for general fitness — including weight loss or staying active — is considered a personal expense, not a medical one.

A treadmill only becomes eligible when its purpose shifts from general exercise to treating or managing a diagnosed medical condition.

When a healthcare provider determines that a treadmill is necessary as part of a treatment plan, its classification changes.

With proper documentation — typically a Letter of Medical Necessity — the treadmill can be treated as a medical expense rather than a fitness purchase. Without that documentation, most FSA and HSA administrators will deny reimbursement.

When a Treadmill May Be FSA or HSA Eligible

A treadmill may qualify only if it is medically necessary and supported by proper documentation.

Common Medical Scenarios That May Qualify

While eligibility is determined case-by-case, treadmills are most commonly approved when prescribed to help manage or treat conditions such as:

- Heart disease or cardiac rehabilitation

- Type 2 diabetes with a prescribed exercise protocol

- Obesity when part of a documented medical treatment plan

- Severe arthritis or mobility issues requiring controlled walking

- Post-surgical or injury rehabilitation

In these cases, the treadmill is viewed as medical equipment, not fitness equipment.

The Letter of Medical Necessity (LMN): The Key Requirement

To use FSA or HSA funds for a treadmill, you’ll almost always need a Letter of Medical Necessity (LMN) from a licensed healthcare provider.

What a Valid LMN Must Include

A compliant LMN should clearly state:

- The diagnosed medical condition

- Why a treadmill is necessary to treat or manage that condition

- How the treadmill fits into the patient’s treatment plan

- The expected duration of use

Without this letter, most plan administrators will deny reimbursement, even if the purchase seems health-related.

Important: Many plans require the LMN to be dated before or at the time of purchase, not after.

When a Treadmill Is Not Eligible

A treadmill is not eligible if it’s purchased primarily for:

- General fitness or exercise

- Weight loss without a diagnosed medical condition

- Convenience (e.g., avoiding gym travel)

- Preventative wellness without a prescription

Even though exercise can reduce future health risks, the IRS does not consider general fitness equipment a qualified medical expense.

How Do You Pay For a Treadmill With FSA/HSA?

Option 1: Reimbursement (Most Common)

- Purchase the treadmill with personal funds

- Submit an Itemized receipt & Letter of Medical Necessity

- Receive reimbursement if approved

Option 2: Direct Purchase Through Approved Retailers

Some fitness equipment sellers partner with platforms like Flex or Truemed, which allow checkout using FSA/HSA funds and may help facilitate an LMN.

That said, approval is never guaranteed — your plan administrator still makes the final call.

FSA vs HSA: Does It Matter?

The eligibility rules for treadmills are nearly identical for FSAs and HSAs, but there are practical differences:

- FSA funds expire, HSA funds do not

- As far as reimbursement flexibility, FSA is employer controlled, HSA is individually controlled

- FSA's carry a moderate audit risk, HSA carries a higher risk long term

Because HSAs roll over indefinitely, keeping documentation is especially important in case of future IRS review.

Which Treadmill Brands Are Best as Far As Paying With FSA/HSA?

Some brands have official partnerships or checkout pathways that allow you to use your FSA/HSA card directly or simplify the reimbursement process:

- NordicTrack and ProForm (via iFIT & Flex) now support HSA/FSA payment options at checkout on eligible equipment.

- Sole Fitness, Matrix and Life Fitness now offer Truemed at checkout as an HSA/FSA payment option

- Sunny Health & Fitness also started offering Truemed as an option.

Those are the current ones offering Flex or Truemed...there will probably be more in the near future.

What's the Bottom Line?

While it might be possible to buy a treadmill with your FSA or HSA, the IRS and plan administrators treat it as a medical expense only when it’s truly necessary to treat a diagnosed condition, backed by a Letter of Medical Necessity. That means it’s not a simple “fitness” purchase — it must be part of a prescribed therapeutic regimen to qualify.

To get the ball rolling, talk with your healthcare provider about your condition and whether a treadmill is medically justified. If it is, request a Letter of Medical Necessity, clearly stating diagnosis and treatment purpose.

Be sure to verify with your FSA/HSA administrator ahead of time — both eligibility and documentation requirements can vary by plan. If you're buying from a retailer partnered with Flex/Truemed, use their checkout process as directed.

Also keep all receipts, the LMN, and documentation for your records in case of audits.

UPDATE: January Treadmill Sales are on!

SEE THE BEST CURRENT DEALS HERE

Best By Price

Cheap

Under $500

$500-$1000

$1000-$2000

$2000-$3000

$3000-$4000+

Best By Type

Best Overall

Best For Walkers

Best For Runners

Best Incline

Best Folding

Best Manual

Consumer Reviews

Rave or rant about the treadmill you bought or used at the fitness center. Read reviews submitted by others.